Keeping and managing your finances in order is crucial to your success as a small or medium business owner. But with an overwhelming number of accounting software options available on the market. Choosing the right one can take time and effort. That’s why we’ve researched and compiled a list of the top best 5 accounting software for small and medium businesses in 2023! Whether you’re looking for user-friendly interfaces or robust features, there’s something on this list for everyone. So please sit back and relax, grab a cup of coffee, and let us guide you toward the perfect accounting solution for your business needs!

Introduction

When it comes to accounting software, there are a lot of options out there. But which one is the right fit for your small or medium business?

This blog post will review the top accounting software options for small and medium businesses. We’ll cover features, pricing, and more so you can make the best decision for your small or medium business.

What is Accounting Software?

Accounting software is a computer program that helps businesses manage their financial affairs. It can track income and expenses, prepare invoices and financial statements, and manage accounts receivable and payable. Accounting software can also automate bookkeeping tasks such as data entry, invoicing, and payments.

Many types of accounting software are available, ranging from simple programs that only track income and expenses to more complex solutions that provide full-fledged accounting and bookkeeping capabilities. The type of software you need will depend on the size and complexity of your business and your specific accounting needs.

Suppose you’re starting a business or have a small business with simple accounting needs. In that case, you may only need a basic accounting program like QuickBooks or FreshBooks. These programs are easy to use and don’t require any prior accounting knowledge. They can help you track income and expenses, prepare invoices, and manage your accounts receivable and payable.

For businesses with more complex needs, mid-range accounting programs like Sage 50cloud Accounting or Xero offer additional features such as inventory management, project tracking, time tracking, multi-currency support, and advanced reporting. These programs are more suitable for businesses that have outgrown the basic features of entry-level accounting software.

Some enterprise-grade accounting solutions like Microsoft Dynamics GP or Oracle NetSuite offer comprehensive financial management capabilities for large.

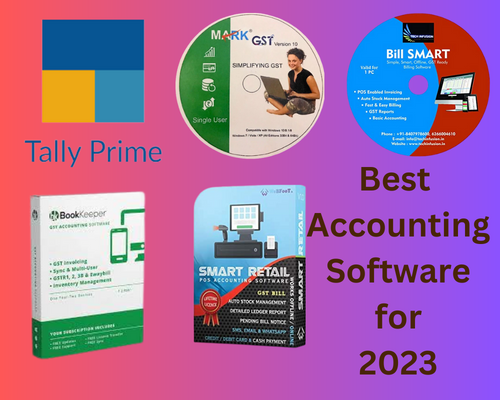

Top 5 Best Accounting Software for Small and Medium Businesses in 2023

TallyPrime

If you’re looking for comprehensive software to manage your business, TallyPrime Silver is the perfect solution. It comes with the latest release of TallyPrime, which includes features for accounting, GST, invoicing, inventory, MIS, and more. This software allows you to easily create and issue professional GST invoices (including e-invoices), file accurate GST returns, and track your business performance. Plus, it’s easy to install and use – no CD required. Simply purchase and download the software online, and you’ll be up and running and using it in no time.

Pros:

• TallyPrime Silver is a comprehensive software that can help manage your business.

• It comes with the latest release of TallyPrime, which includes features for accounting, GST, invoicing, inventory, MIS, and more.

• With this software, you can easily create and issue professional GST invoices (including e-invoices).

• You can also file accurate GST returns and easily track your business performance.

• The software is also very user-friendly and easy to navigate.

Cons:

• It might be slightly expensive for small businesses or startups.

• There might be a learning curve involved in using the software to its full potential.

Mark GST Billing and Best Accounting Software

Mark GST Billing Software is a 3-in-1 accounting, stock, and GST management software that is perfect for small businesses such as computer stores, vegetable/fruit stores, hardware stores, and automobile stores. The software is compatible with all editions of Windows 7, 8, 8.1, and 10 (32-bit and 64-bit) and does not require an internet connection. It supports multiple bill print formats such as A4, A5, and POS (customizable optional) and comes with free cloud backup.

Pros:

• Easy to use

• No internet connection is required

• Supports multiple bill print formats

• Perfect for small businesses

• 3-in-1 accounting, stock, and GST management software

Cons:

• Not suitable for businesses with complex inventory

• Limited customization options

• Does not support online payment

BILL SMART

BILL SMART is a GST-compliant billing and invoicing software that makes managing your finances easy. It has all the features to streamline your billing process, including creating and managing invoices, payments, and refunds. With BILL SMART, you can easily track your financial progress and stay on your game.

Pros:

• GST compliance – BILL SMART is GST compliant, so you can be sure that your financial records are current and compliant with the law.

• Easy to use – The software is easy to use, so you can quickly start creating and managing your invoices.

• Streamlined billing process – BILL SMART streamlines your billing process, so you can save time and effort in managing your finances.

• Progress tracking – With BILL SMART, you can easily track your financial progress and stay on top of your game.

• Affordable – BILL SMART is an affordable billing and invoicing solution that offers excellent value for money.

Cons:

• Limited features – BILL SMART has limited features compared to other billing and invoicing solutions.

• No mobile app – No mobile app is available for BILL SMART, so you can only use it on your computer or laptop.

• Not suitable for businesses with complex billing requirements – If you have a business with complex billing requirements, BILL SMART may not be the right solution for you.

WeBFooT SMART RETAIL

WeBFooT SMART RETAIL is a cost-effective and GST-compliant billing software that makes sale, purchase, and accounting management easy. With its customer and supplier management features, you can easily track payments and invoices. The stock management feature helps you keep track of your inventory levels, and the software automatically updates the inventory when a purchase entry or invoice is generated. SMART RETAIL is also POS-enabled to generate GST invoices quickly and easily. The software comes with a lifetime license and one-time free bill customization.

Pros:

• Cost effective

• GST compliant

• Easy to use

• Customer and supplier management features

• Stock management feature

Cons:

• Requires internet connection

• May not be compatible with all operating systems•. Limited support

Book Keeper App

Book Keeper App is an easy-to-use GST accounting software that helps you generate and print invoices as per the GST format. It lets you generate GST returns (GSTR1, 2, 3B, 4) in JSON or Excel offline utility. With Book Keeper App, you can easily track and manage your stocks, raw materials, and finished goods.

Pros:

• Easy to use

• Generates and prints invoices as per GST format

• Allows you to generate GST returns offline

• Easily track and manage your stocks, raw materials, and finished goods

• Available on both Android and iOS platforms

Cons:

• Does not offer a free trial period

• Limited features compared to other accounting software

• Not suitable for businesses with complex inventory

Features to look in the Best Accounting Software

Regarding accounting best software, there are a few key features you should look for to ensure that you’re getting the best possible solution for your small or medium business. Below are some of the top features to look for in the best accounting software:

1. Ease of use: The best accounting software should be easy to use, even if you’re not an accountant or have no prior experience with accounting software. Look for a solution with a user-friendly interface and intuitive controls.

2. Comprehensive features: The best accounting software should offer all the features you need to manage your finances, including invoicing, tracking expenses, and preparing financial reports. Be sure the software you choose has all the features you need and is scalable to grow with your business.

3. Affordable price: Don’t overspend on your accounting software – look for a solution that offers excellent value for money. Plenty of high-quality, affordable accounting solutions are on the market, so shop around to find the best deal.

4. Reliable customer support: When something goes wrong with your accounting software, you want help from a reliable customer support team. Look for a vendor with a reputation for providing excellent customer service in case you need any assistance using the software or troubleshooting any issues.

Benefits of Using an Accounting Software for SMBs

Using accounting software for small and medium businesses has many benefits. The most obvious benefit is that it can save the business time and money. With accounting software, businesses can automate their financial tasks, freeing time for the business owner to focus on other business areas. Additionally, accounting software can help businesses keep track of their finances and budget better, leading to improved financial decision-making.

Another benefit of using accounting software is that it can help businesses manage their inventory better. With accounting software, businesses can track their inventory levels and see when to order more products. This can help businesses avoid stockouts and lost sales opportunities. Additionally, accounting software can help businesses keep track of their spending on inventory, allowing them to control their expenses better.

Accounting software can help businesses improve their customer service. With accounting software, businesses can automate their invoicing and payment processes. This can make it easier for customers to pay their invoices on time and receive their products or services promptly. Additionally, an automated invoicing and payments process can reduce the chances of errors, which can improve customer satisfaction levels.

Conclusion

To sum up, choosing the right accounting software for your small or medium business can be a daunting task. We hope this article has helped you narrow down your choices and decide which software best suits your needs. With the right accounting software, you can easily manage finances, payrolls, taxes, and more. Investing in good quality accounting software will ensure your business runs smoothly and efficiently for years.

The right software can greatly help your small or medium business. It can save time and money by helping you keep track of all your financial operations and making the process of filing taxes and completing payroll easier. Additionally, it can provide detailed reports and analysis to help you understand the financial status of your company and make strategic decisions. With the right software, you will have the tools to ensure your business remains successful for many years. Lastly, any one of the above accounting software you can consider for your small or medium business all are good and reliable to small or medium business.

Be the first to comment